Michigan Sugar Company is getting a 22.7% boost in its production allocation from USDA — the most of any beet processor in the nation — thanks to changes in USDA rules aimed at boosting U.S. sugar production.

The increase comes as USDA announced Wednesday it will allow for allocations to be transferred between sugarbeet processors in the 2022 fiscal year as part of a three-pronged push to meet sugar demand.

Citing a need for additional sugar supplies in the U.S. market due to Hurricane Ida and supply chain disruptions, USDA is transferring allocations from beet processors with surplus allocations to those with deficit allocations.

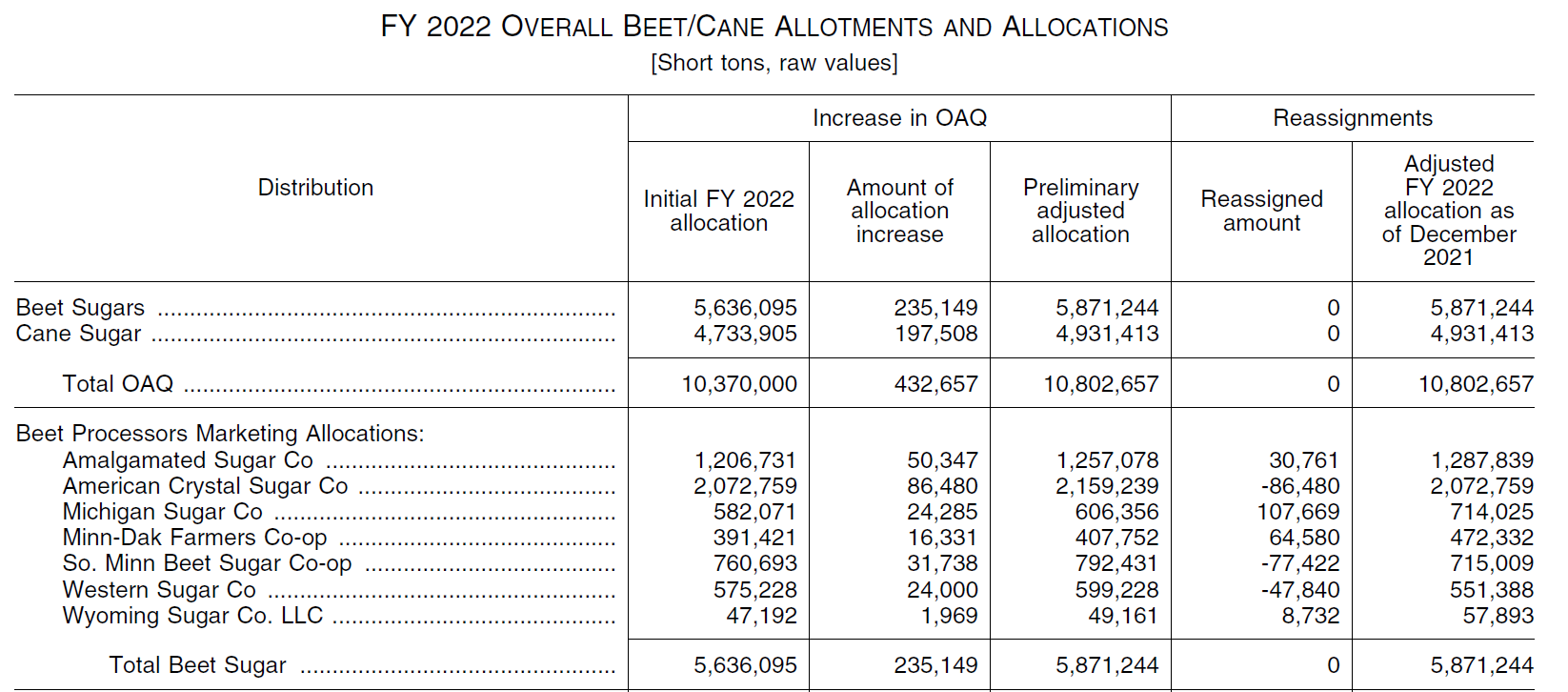

Additionally, USDA also increased the overall allotment quantity (OAQ) by 432,657 short tons raw value (STRV) — now totaling 10,802,657 — which is divided between beet (54.35%) and cane sugar (45.65%).

According to the USDA announcement, both steps were necessary to allow all beet processors to market all of their expected FY22 beet sugar supply.

Currently, some beet processors anticipate that their FY22 beet sugar supply will exceed their FY22 marketing allotment, a phenomenon known as “blocked stocks.” Absent action by USDA, beet processors with blocked stocks would be unable to market their entire supply.

Michigan Sugar Company, a Bay City sugarbeet cooperative, is seeing an overall increase of 131,954 STRV for the 2022 fiscal year — more than the other three processors receiving increases combined.

The news comes on the heels of a record year for Michigan sugarbeet growers. In fact, the tonnage per acre was so impressive that Michigan Sugar required growers to leave 5% of their crop in the ground to help manage processing.

“With a crop this big, you run the danger of not even finishing by May,” Michigan Sugar Company President & CEO Mark Flegenheimer said in November. “That’s not a position we want to get into because by then managing the sugarbeet piles becomes too challenging a task.”

Michigan Sugar also added a voluntary buy-back programs that allowed growers to be paid for additional acres they left unharvested, based on averages paid for their already delivered crop.

Other USDA actions

A temporary increase in raw sugar cane imports is also on the way, with USDA upping Mexico’s export limit by 150,000 STRV. That sugar has to be exported by March 31, 2022.

U.S. raw cane sugar production is currently estimated to be about 220,000 STRV lower than in FY21 while raw cane sugar TRQ imports are estimated to be about 165,000 STRV lower.

USDA says it will closely monitor stocks, consumption, imports and all sugar market and program variables on an ongoing basis and may make further program adjustments during the FY2022 if needed.