High food prices have been on U.S. consumers’ minds for several years now. From 2019 to 2023, the food Consumer Price Index rose by about 25 percent, much of which is attributed to supply chain disruptions (USDA ERS, 2023).

However, as measures of inflation cool and political campaigns heat up, the public discourse about high food prices seems to have turned to companies’ pricing strategies and market power (see e.g., Bork, March 4, 2023; Henney March 1, 2024; Smialek, March 1, 2024; Smialek and Karaian, February 20, 2024; Tankersley, February 26, 2024; Picchi, February 13, 2024; Tankersley, February 1, 2024).

At the federal level, for example, we recently saw the Federal Trade Commission sue to block a grocery store merger between Kroger and Albertsons – with the grocery stores saying the merger would reduce food prices and the FTC saying that the merger would raise food prices (Durbin, February 26, 2024).

So, what does the public think?

In this article, we explore U.S. consumers’ perceptions of firm size and pricing strategies of four important players in the food system – farmers, food manufacturers, grocery stores, and restaurants – using results from the most recent wave of the Gardner Food and Agricultural Policy Survey. We also investigate how consumers perceive firm size to be related to different measures of food quality, including safety, taste, and affordability.

Methods

The Gardner Food and Agriculture Policy Survey is an online, quarterly survey meant to track and evaluate U.S. consumers’ perceptions of food and agricultural issues. Each quarter, a new panel of approximately 1,000 participants is recruited to match the U.S. population in terms of gender, age, annual household income, and US census region. Results presented here are from the eighth wave of the survey, conducted in February 2024.

Results

U.S. Consumers’ Perceptions of Firm Size Across the Food System

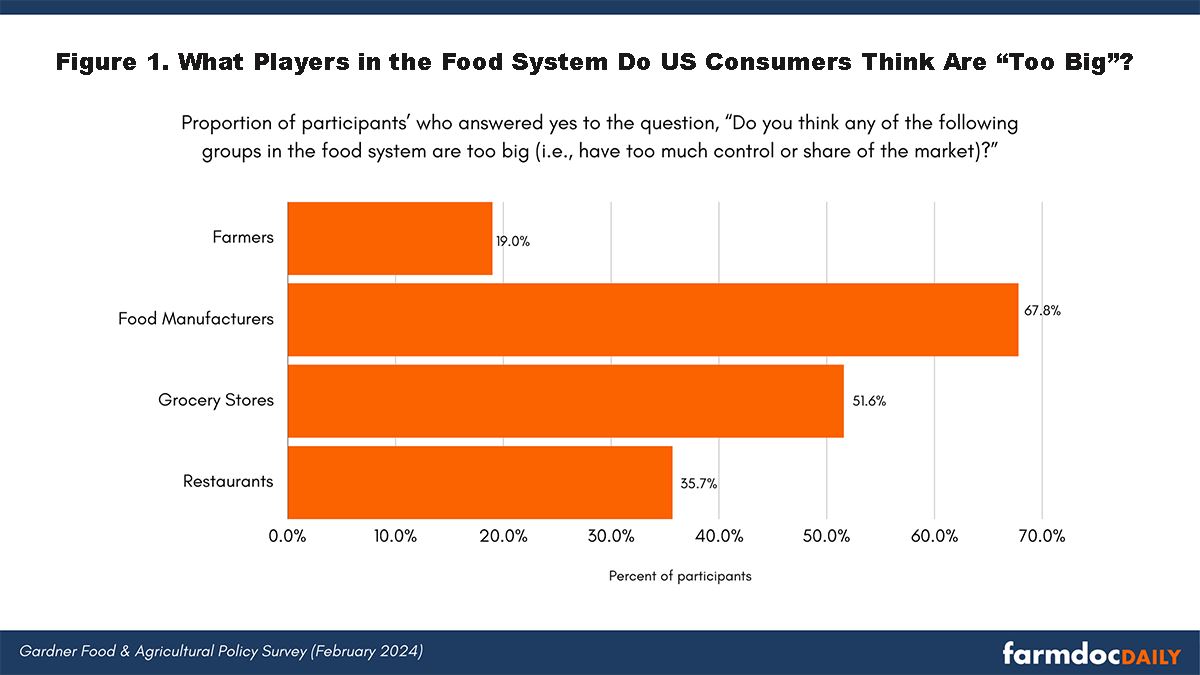

To explore perceptions of firm size for farmers, food manufacturers, grocery stores, and restaurants, we asked participants, “Do you think any of the following groups in the food system are too big (i.e., have too much control or share of the market)?” Figure 1 shows the proportion of participants who said yes to the question for each player in the food system. Participants were also able to answer No and I don’t know. We find that the majority of consumers are concerned about the size of food manufacturers and grocery stores, with 67.8 percent and 51.6 percent indicating that these types of players in the food system are too big, respectively. Fewer thought that either restaurants (35.7 percent) or farms (19.0 percent) were too large.

As this has become a focal point early in this election year, we also compare responses across participants’ self-reported political parties. Of our sample of 1,035 participants, 32.6 percent indicated they were Republican (n=337), 36.7 percent that they were Democratic (n=380), and 30.7 percent that they were Independent or Other (n=318). We find that the majority of consumers across political parties thought food manufacturers and grocery stores were ‘too big’ – highlighting that concerns about firm size have become a priority across party lines (see Table 1).

Table 1. Proportion of Participants Who Indicated They Think Each Group in the Food System Is Too Big, Across Participants’ Self-Reported Reported Political Party

|

|

Farmers

|

Food Manufacturers

|

Grocery Stores

|

Restaurants

|

|

Republican Participants

|

17.9%

|

64.4%

|

52.1%

|

37.4%

|

|

Democratic Participants

|

24.5%

|

69.9%

|

51.3%

|

35.8%

|

|

Independent/Other Participants

|

13.5%

|

68.9%

|

51.6%

|

33.7%

|

U.S. Consumers’ Perceptions of Overcharging Across the Food System

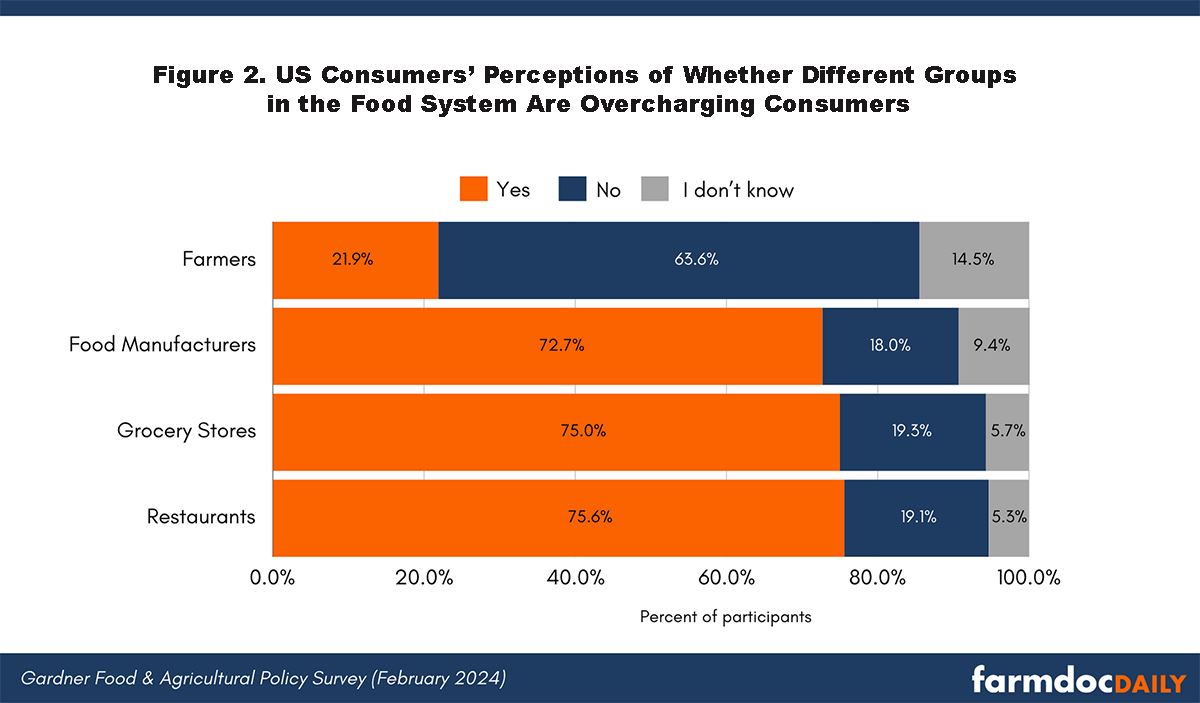

To explore perceptions of pricing, we asked participants whether they thought any of the four groups in the food system are overcharging consumers. Figure 2 presents the results. We find that over 70 percent of consumers think that restaurants, grocery stores, and food manufacturers are overcharging them. Far fewer (21.9 percent) thought that farmers were overcharging consumers.

Similar to perceptions of firm size, we compare responses of overcharging across participants’ self-reported political parties (see Table 2). We find little variation across political party, underscoring the ubiquity of the issue for consumers across the political spectrum.

Table 2. Proportion of Participants Who Indicated They Think Each Group in the Food System Is Overcharging Consumers, Across Participants’ Self-Reported Reported Political Party

|

|

Farmers

|

Food Manufacturers

|

Grocery Stores

|

Restaurants

|

|

Republican Participants

|

22.9%

|

75.7%

|

76.6%

|

75.7%

|

|

Democratic Participants

|

24.5%

|

71.6%

|

74.7%

|

76.1%

|

|

Independent/Other Participants

|

17.9%

|

70.8%

|

73.6%

|

74.8%

|

Food Firm Size and Perceptions of Quality

In addition to understanding consumers’ perception of food system players’ pricing and size generally, we wanted to understand how consumers related firm size to measures of quality.

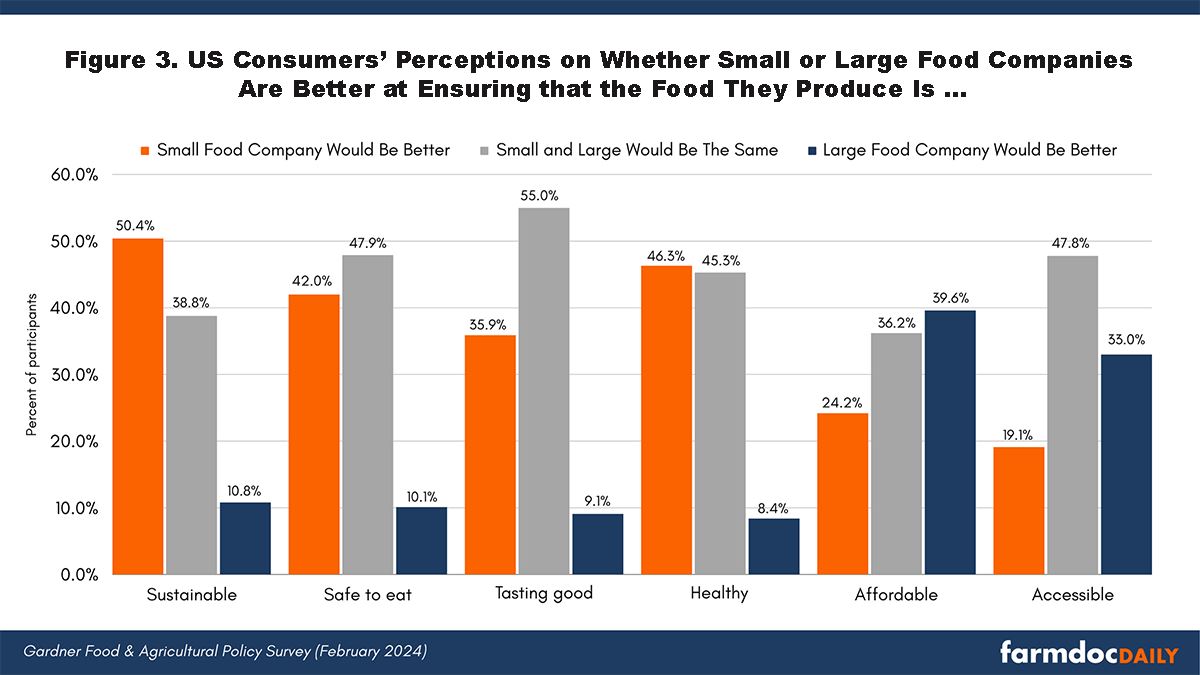

To do so, we asked participants to indicate whether they thought small or large food companies would be better (or equivalent) at ensuring the food they produce is sustainable, safe to eat, tastes good, healthy, affordable, and accessible. For this question, participants were asked to think about food companies that manufacture, process, or sell food. Figure 3 presents these results.

We find that more consumers believe large food companies are better at ensuring the food they produce is affordable. More consumers also believe that small food companies are better at ensuring their food is sustainable and healthy. Finally, more consumers believe that food companies of both sizes are equivalent at producing food that was safe, tasty, and accessible.

Conclusions

Using results from the Gardner Food and Agricultural Policy Survey, we aimed to understand U.S. consumers’ perceptions of the size and pricing strategies of important players in the food system. We also looked to evaluate how consumers perceive the size of a food company to be related to measures different measures of food quality (e.g., taste, safety, affordability).

Our results indicate that over 65 percent of consumers think food manufacturers are too big or have too much market power. We also find that about half of consumers are also concerned about the size of grocery stores – especially relevant as the Federal Trade Commission sues to block a merger between Kroger and Albertsons (Durbin, February 26, 2024). Consumers generally do not believe that either farms or restaurants are too large.

As for pricing, we find that more than 70 percent of consumers think that food manufacturers, grocery stores, and restaurants are overcharging consumers. The only player in the food system consumers did not think was overcharging them was farmers. Our results are consistent with a recent survey by Data for Progress (Todaro, February 12, 2024) that polled ‘likely voters’ on similar issues. Their results show that consumers place much of the blame for high food prices on food manufacturers and grocery stores.

Food prices have been at the center of political campaigns, so here we explore perceptions across participants’ politics. Notably, we find that neither perception of pricing nor firm size differed substantially across political parties – consumers across the aisle believe they are being overcharged for food and that some participants in the food system (food manufacturers and grocery stores) are too large.

Finally, while consumers think food manufacturers and grocery stores are too large and are overcharging consumers, they also believe that large food firms are better than small firms at keeping food affordable – so consumer support for policies aimed at pricing strategies or market power seem less clear. They also believe smaller food companies are better at ensuring other important food qualities (e.g., sustainability, healthfulness).

While we do not explore perceptions of potential responses in our survey, results from two other voting-focused surveys found some support for certain grocery store actions, including labels identifying products that have changed sizes, and some policy actions, including the federal government fining companies who raise prices beyond the rate of inflation (Todaro, February 12, 2024; YouGov, January 12, 2024). This will certainly be an area for all participants along the food chain to be watching in the coming year.

References

- Bork, R.H. “The FTC’s Case against the Kroger/Albertsons Deal Puts Politics Before Economics.” National Review. 2024. https://www.nationalreview.com/2024/03/the-ftcs-case-against-the-kroger-albertsons-deal-puts-politics-before-economics/

- Durbin, D.A. “US sues to block merger of grocery giants Kroger and Albertsons, saying it could push prices higher.” AP News. 2024. https://apnews.com/article/kroger-albertsons-antitrust-grocery-merger-competition-71b47dc86ec7449f29b2b488c1d3f9de

- Henney, M. “Why are groceries still so expensive?” Fox Business. 2024. https://www.foxbusiness.com/economy/why-are-groceries-still-so-expensive

- Picchi, A. “Inflation is cooling. So why are food prices, from steak to fast-food meals, still rising?” CBS News – MoneyWatch. 2024. https://www.cbsnews.com/news/food-prices-grocery-inflation-biden-economy/

- Smialek, J. “Shrinkflation 101: The Economics of Smaller Groceries.” The New York Times. 2024. https://www.nytimes.com/2024/03/01/business/economy/shrinkflation-groceries.html

- Smialek, J. and Karaian, J. “Will Food Prices Stop Rising Quickly? Many Companies Say Yes.” The New York Times. 2024. https://www.nytimes.com/2024/02/20/business/economy/food-price-inflation-cools.html

- Tankersley, J. “Biden Takes Aim at Grocery Chains Over Food Prices.” The New York Times. 2024. https://www.nytimes.com/2024/02/01/us/politics/biden-food-prices.html

- Tankersley, J. “Biden Targets a New Economic Villain: Shrinkflation.” The New York Times. 2024. https://www.nytimes.com/2024/02/26/us/politics/biden-prices-shrinkflation.html

- Torado, R. “Voters Who Are Concerned About Inflation Are Mostly Concerned About Grocery Prices — and Overwhelmingly Support Taking Action Against ‘Shrinkflation.’” Data For Progress. 2024. https://www.dataforprogress.org/blog/2024/2/12/voters-concerned-about-inflation-are-mostly-concerned-about-grocery-prices-overwhelmingly-support-action-against-shrinkflation

- “U.S. food prices rose by 25 percent from 2019 to 2023.” USDA-ERS. 2024. https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=58350

The entire story is here: Permalink

Kalaitzandonakes, M., J. Coppess and B. Ellison. "Sizing Up the Food System: US Consumers’ Perceptions of Food System Firm Sizes and Pricing." farmdoc daily (14):47, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 7, 2024. Kalaitzandonakes and Coppess are with the Department of Agricultural and Consumer Economics, University of Illinois while Ellison is with the Department of Agricultural Economics, Purdue University