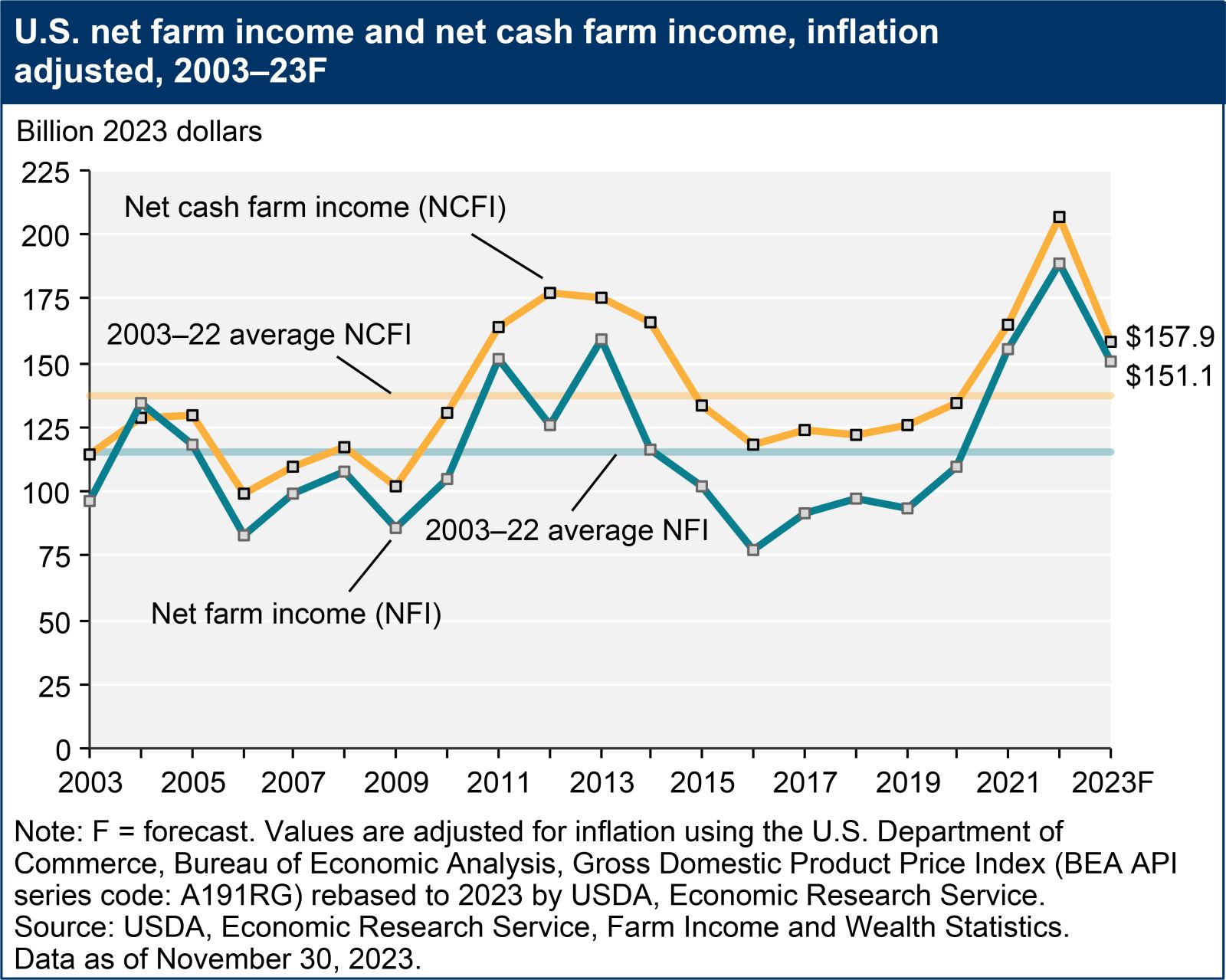

Farm sector income is forecast to fall in 2023 after reaching record highs in 2022. Net farm income, a broad measure of profits, reached $182.8 billion in calendar year 2022, increasing $42.4 billion (30.2 percent) from 2021 in nominal dollars. In 2023, net farm income is forecast to decrease by $31.8 billion (17.4 percent) from 2022 to $151.1 billion.

Net cash farm income reached $200.4 billion in 2022, increasing $51.1 billion (34.2 percent) from 2021. It is forecast to decrease by $42.5 billion (21.2 percent) from 2022 to $157.9 billion in 2023. In inflation-adjusted 2023 dollars, net farm income is forecast to decrease by $37.9 billion (20.0 percent) in 2023, and net cash farm income is forecast to decrease by $49.2 billion (23.8 percent) compared with the previous year. If realized, both income measures would remain above their 2003-22 averages (in inflation-adjusted dollars).

See a summary of the forecasts in the table U.S. farm sector financial indicators, 2016–2023F, or see all data tables on farm income and wealth statistics.

Note: In the text below, year-to-year changes in the major aggregate components of farm income are discussed only in nominal dollars unless the direction of the change is reversed when looking at the component in inflation-adjusted dollars.

Summary Findings

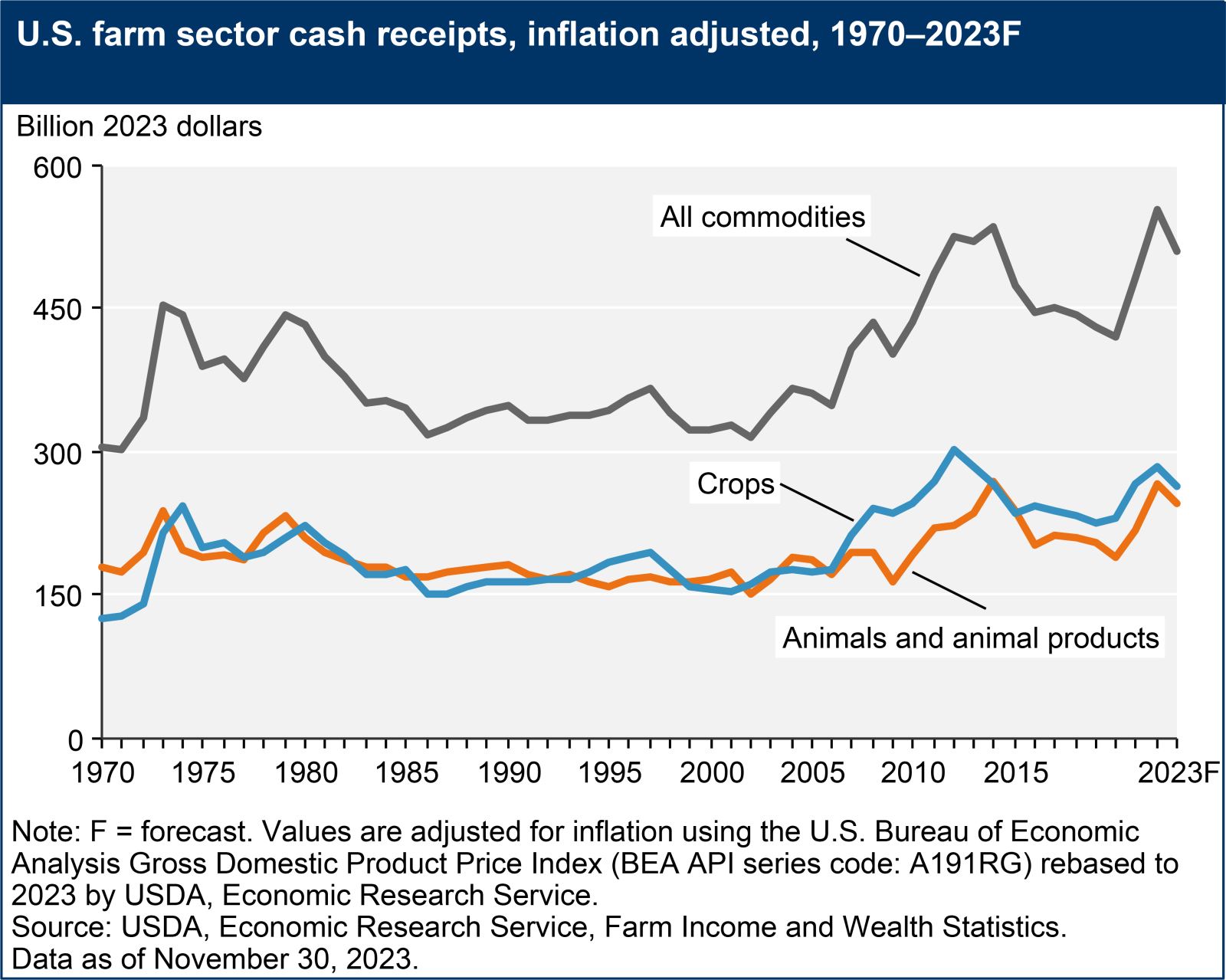

- Overall, farm cash receipts are forecast to decrease by $25.2 billion (4.7 percent) from 2022 to $509.6 billion in 2023 in nominal dollars. Total crop receipts are forecast to decrease by $12.1 billion (4.4 percent) from 2022 levels to $264.2 billion. Receipts for soybeans, corn, and cotton are forecast to decrease while receipts for fruit/nuts and hay are forecast to increase. Total animal/animal product receipts are projected to decrease by $13.0 billion (5.0 percent) to $245.4 billion, following declines in receipts for milk, broilers, eggs, and hogs while receipts for cattle/calves are forecast to increase.

- Direct Government farm payments are forecast at $12.1 billion in 2023, a $3.5-billion (22.3 percent) decrease from 2022. Direct Government farm payments include Federal farm program payments paid directly to farmers and ranchers but exclude U.S. Department of Agriculture (USDA) loans and insurance indemnity payments made by the Federal Crop Insurance Corporation (FCIC). This decline follows lower supplemental and ad hoc disaster assistance to farmers and ranchers compared with 2022.

- Total production expenses, including those associated with operator dwellings, are forecast to increase by $14.9 billion (3.5 percent) in 2023 to $443.4 billion. Interest expenses and livestock/poultry purchases are expected to see the largest increases in 2023 while spending on fertilizer/lime/soil conditioners, fuels/oils, and feed is expected to decline relative to 2022.

- Farm sector equity is expected to increase by 6.9 percent ($229.4 billion) in 2023 to $3.57 trillion in nominal terms. Farm sector assets are forecast to increase 6.6 percent ($254.0 billion) in 2023 to $4.09 trillion following expected increases in the value of farm real estate assets. Farm sector debt is forecast to increase 5.0 percent ($24.6 billion) in 2023 to $520.7 billion. Debt-to-asset levels for the sector are forecast to improve from 12.93 percent in 2022 to 12.73 percent in 2023. Working capital is forecast to fall 5.0 percent in 2023 relative to 2022.

Total Cash Receipts Forecast To Decline From A Record High In 2022

Total inflation-adjusted cash receipts are forecast to fall $43.0 billion (7.8 percent) from 2022 to $509.6 billion in 2023. Crop cash receipts are projected to decline $21.4 billion (7.5 percent) in 2023. Similarly, animal/animal product cash receipts are expected to decline $21.7 billion (8.1 percent).

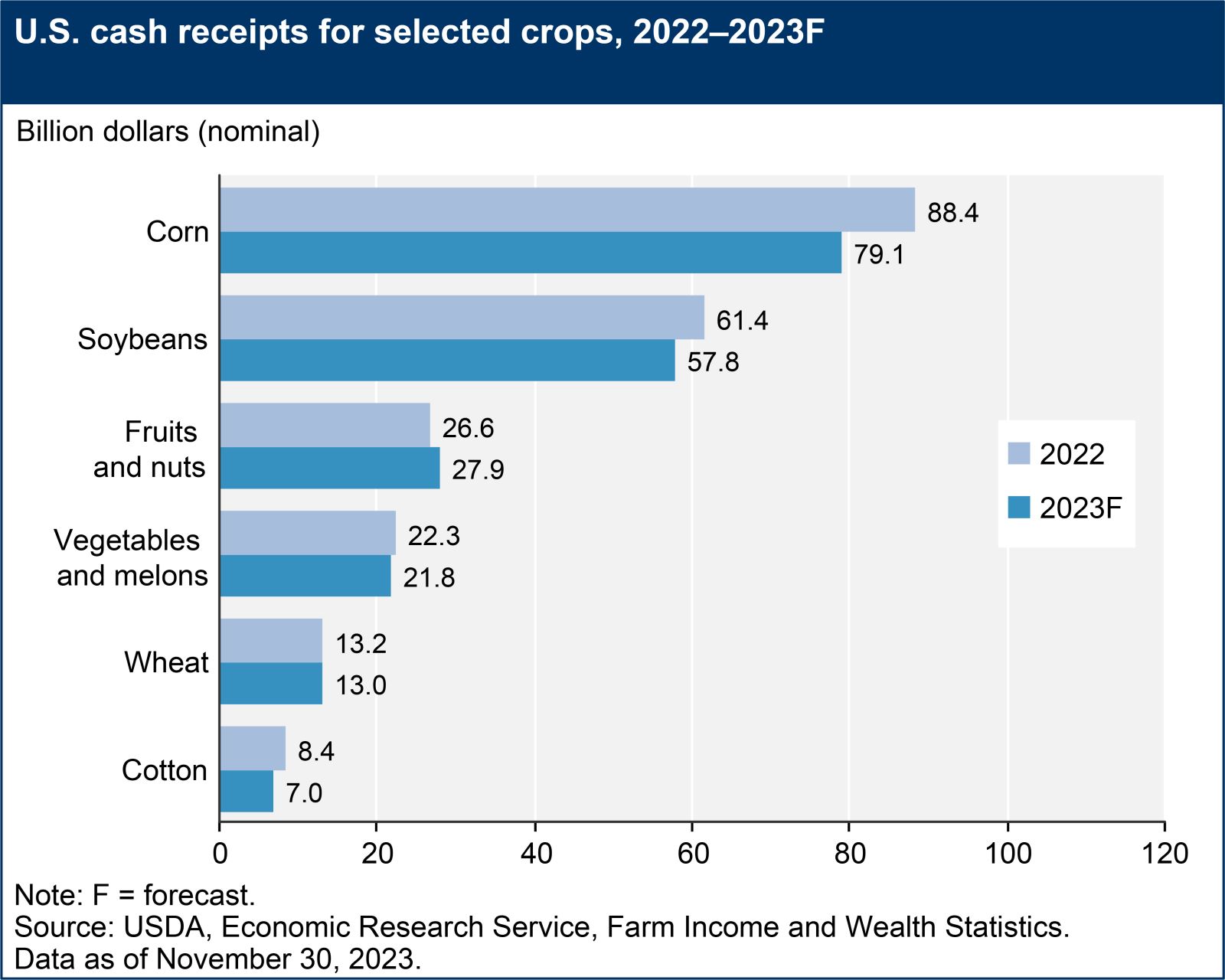

Crop Receipts Projected To Fall In 2023

Crop cash receipts are forecast at $264.2 billion in 2023, a decrease of $12.1 billion (4.4 percent) from 2022 in nominal terms. Combined receipts for corn, soybeans, and cotton are forecast to fall $14.4 billion, although fruit and nut receipts are expected to increase.

Corn receipts are expected to fall by $9.4 billion (10.6 percent), because of lower expected prices in 2023. Soybean receipts are forecast to decrease by $3.6 billion (5.9 percent) in 2023, caused by lower expected prices and quantities. Lower forecasted prices and quantities will result in a decrease of $1.4 billion (16.9 percent) in total cotton receipts. Wheat receipts are forecast to decrease $0.2 billion (1.3 percent), as lower prices will outweigh higher quantities sold. Receipts for hay are projected to increase $0.9 billion (8.6 percent), based on expectations for both higher prices and quantities sold.

Vegetable and melon cash receipts are expected to fall $0.5 billion (2.4 percent) in 2023 due to falling prices. However, this total includes projected growth of $0.6 billion in potato receipts. Rising prices are expected to drive receipts for fruit and nuts $1.2 billion (4.7 percent) higher during the year. Growth of $0.1 billion (4.5 percent) in sugarcane receipts is also forecast for 2023, while sorghum receipts are projected to fall $0.3 billion (17.1 percent).

See data on value of crop production (in the value added table) and crop cash receipts.

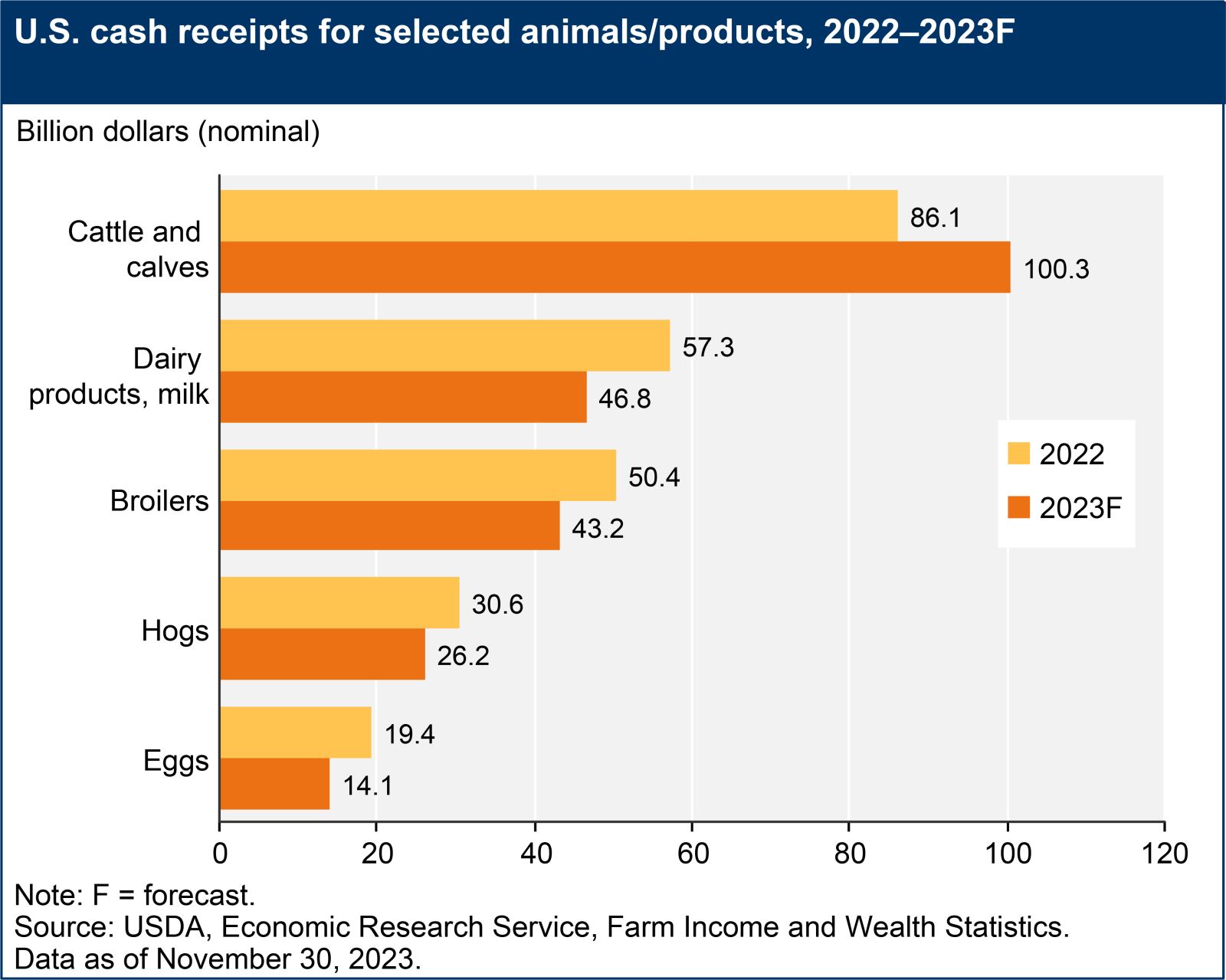

Animal/Animal Product Receipts Forecast To Decrease In 2023

Total animal/animal product cash receipts are expected to decrease $13.0 billion (5.0 percent in nominal terms) from 2022 to $245.4 billion in 2023. While receipts for most major animal/animal products are projected to fall, receipts for cattle and calves are expected to increase during the year.

Milk receipts are expected to decrease $10.5 billion (18.3 percent) in 2023 due to lower prices. Cash receipts from cattle and calves are expected to increase $14.3 billion (16.6 percent), as price growth is expected to outpace falling quantities sold. However, negative price effects should outweigh slightly higher quantities for hog receipts, resulting in a decrease of $4.4 billion (14.2 percent) in 2023.

Broiler receipts are expected to fall $7.2 billion (14.3 percent) in 2023, due to a lower price forecast. While quantities sold are forecast to rise, lower prices should drive receipts for turkeys $0.2 billion (3.3 percent) lower during the year. Cash receipts for chicken eggs are expected to decrease $5.2 billion (26.9 percent) in 2023 from an all-time high the previous year, as falling prices should outweigh growth in quantities sold.

See data on value of animal/product production (in the value added table) and animal/product cash receipts.

Lower Prices And Quantities Overall Drive Cash Receipts Decline In 2023

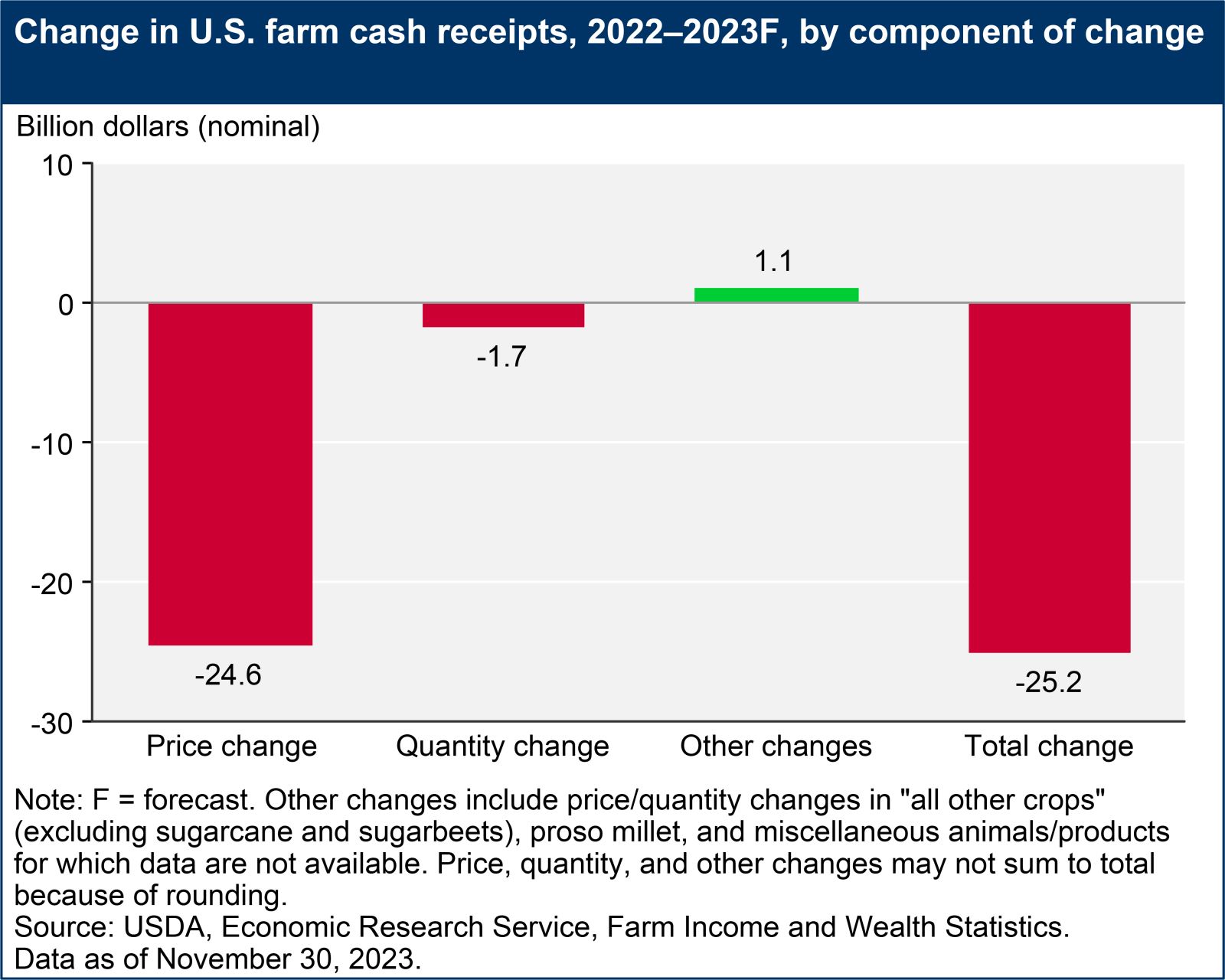

To better understand the factors underlying the forecast change in annual receipts from 2022 to 2023, the change was decomposed into two separate effects: (1) a price effect projecting the change in cash receipts associated with holding the quantity sold constant at 2022 levels and allowing prices to change to forecast 2023 levels; and (2) a quantity effect holding prices constant from 2022 and quantities changing to forecast 2023 levels.

In 2023, falling prices and quantities sold are expected to have negative effects on cash receipts. Overall, cash receipts are forecast to decrease $25.2 billion in nominal terms in 2023, with an estimated negative price effect of $24.6 billion, and a projected negative quantity effect of $1.7 billion. In addition, a net increase of $1.1 billion in cash receipts is from forecasts for commodities whose price and quantity effects cannot be separately determined. Price effects on cash receipts are forecast to be negative for both crop and animal/animal product commodities. Quantity effects are forecast to be negative overall as well as for animal/animal product commodities, but are projected to be positive for crop cash receipts.

Direct Government Farm Payments Forecast To Decrease In 2023

Direct Government farm program payments are those made by the Federal Government directly to farmers and ranchers with no intermediaries. Typically, most direct payments to farmers and ranchers are administered by the USDA using the Farm Bill or related authorities. Direct payments can also come from supplemental programs authorized by Congress.

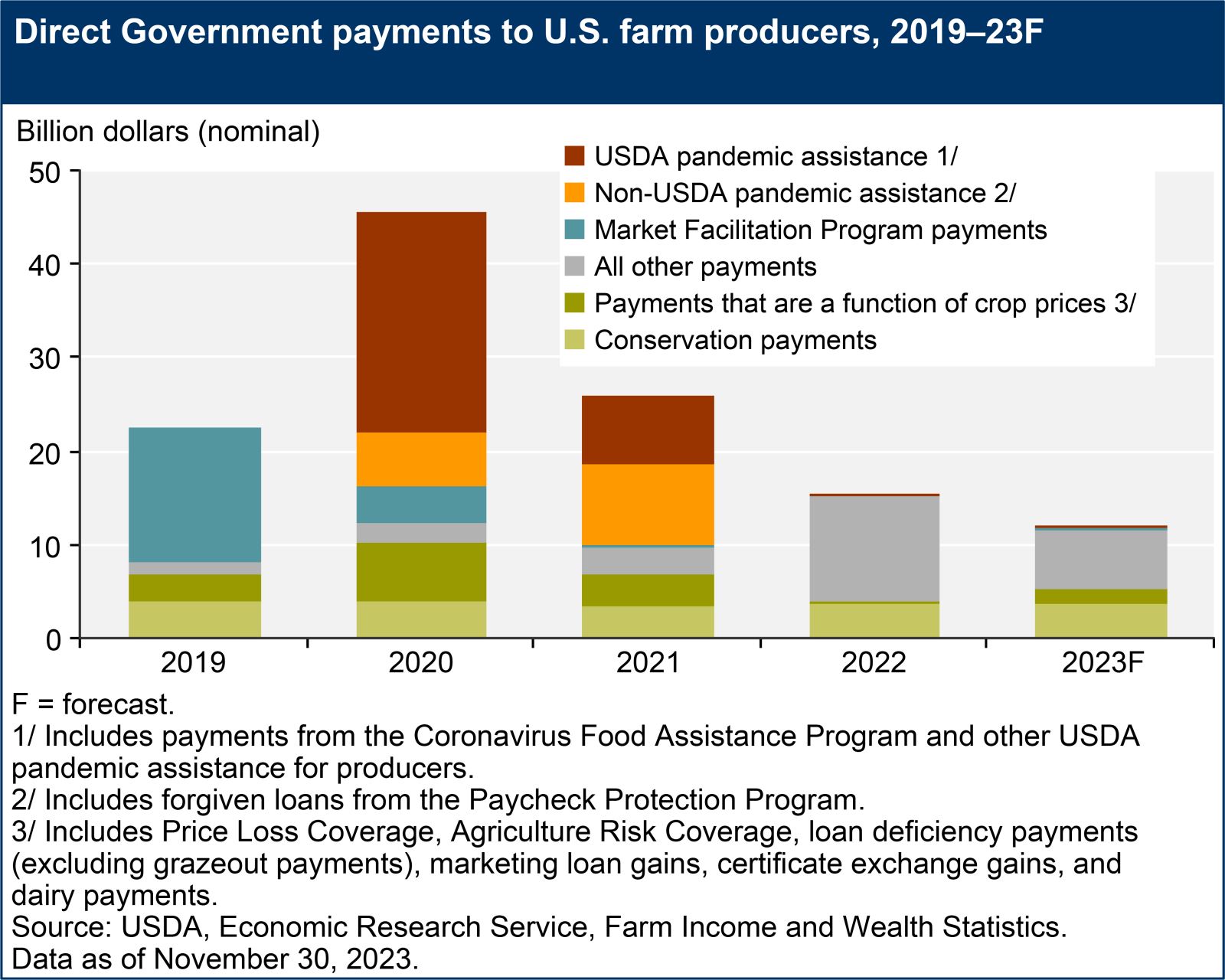

Government payments do not include Federal Crop Insurance Corporation (FCIC) indemnity payments (listed as a separate component of farm income) and USDA loans (listed as a liability in the farm sector’s balance sheet). After reaching a record high of $45.6 billion in calendar year 2020, direct Government farm program payments decreased to $26.0 billion in 2021 and to $15.6 billion in 2022. They are forecast to fall further to $12.1 billion in 2023. The overall decrease from 2020 in direct Government farm program payments primarily reflects lower payments from supplemental and ad hoc disaster assistance, including lower Coronavirus (COVID-19) pandemic assistance.

- Supplemental and ad hoc disaster assistance payments in 2023 are forecast at $6.8 billion, a decrease of $4.7 billion (41.1 percent) from 2022, because of lower payments from other (nonpandemic related) supplemental and ad hoc disaster assistance programs. Since 2020, supplemental and ad hoc disaster assistance has represented the largest category of direct Government payments.

- Other supplemental and ad hoc disaster assistance, which includes Farm Bill designated disaster programs but excludes pandemic assistance, is forecast to be $6.4 billion in 2023, a decrease of $4.9 billion (43.4 percent) from 2022. This is mostly because of lower expected payments from the Emergency Relief Program (ERP).

- USDA pandemic assistance for producers, including from the Coronavirus Food Assistance Program (CFAP), provides relief to producers whose operations are directly affected by the COVID-19 pandemic. Payments in calendar year 2023 from these USDA programs are forecast at $366.0 million compared with $182.3 million and $7.5 billion in 2022 and 2021, respectively.

- Non-USDA pandemic assistance, or payments from the Paycheck Protection Program (PPP), administered by the Small Business Administration (SBA), ended on May 31, 2021, with no payments in 2022 and 2023. Non-USDA pandemic assistance is estimated at $8.6 billion for 2021, based on October 3, 2023, data from the SBA. The PPP payments were designed to help small businesses keep their workers on the payroll through forgivable loans. Forgiven loan amounts to farm operations are treated as a direct payment to the farm sector.

- Conservation payments from the financial assistance programs of USDA's Farm Service Agency (FSA) and Natural Resources Conservation Service (NRCS) are expected to be $3.7 billion in 2023, an increase of $148.5 million (or 4.2 percent) from the 2022 estimate. The increase in conservation payments is due to a marginal increase in Conservation Reserve Program (CRP) enrolled acres, an increase in payments from NRCS programs, and some expected payments from the Inflation Reduction Act (IRA) funds allocated for USDA’s conservation programs.

- The Dairy Margin Coverage Program (DMC) is forecast to make $1.3 billion in payments in 2023, which is up by $1.1 billion compared with 2022. This increase is due to lower milk prices in 2023 compared to 2022.

- Farm bill commodity payments under the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs are forecast to decline by $28.8 million (7.7 percent) in 2023 to $343.7 million compared with $372.5 million in 2022. The ARC program provides income support payments when actual crop revenue declines below a specified guarantee level. ARC payments are expected to be $334.3 million in 2023, an increase of $229.2 million (218.1 percent) from $105.1 million in 2022. Despite market prices significantly exceeding benchmark prices for the 2022 crop year, low yields triggered ARC payments in some counties for seed cotton, wheat, corn, soybeans, and grain sorghum. The PLC program provides income support payments when the effective price of a covered commodity falls below its effective reference price. PLC payments in 2023 are expected be $9.4 million, a decrease of $258.0 million (or 96.5 percent) from $267.4 million in 2022. PLC payments are expected to decrease in 2023 because of higher commodity prices for covered commodities in 2022 compared with 2021.

See data table on Government payments.

Production Expenses Forecast To Increase In 2023

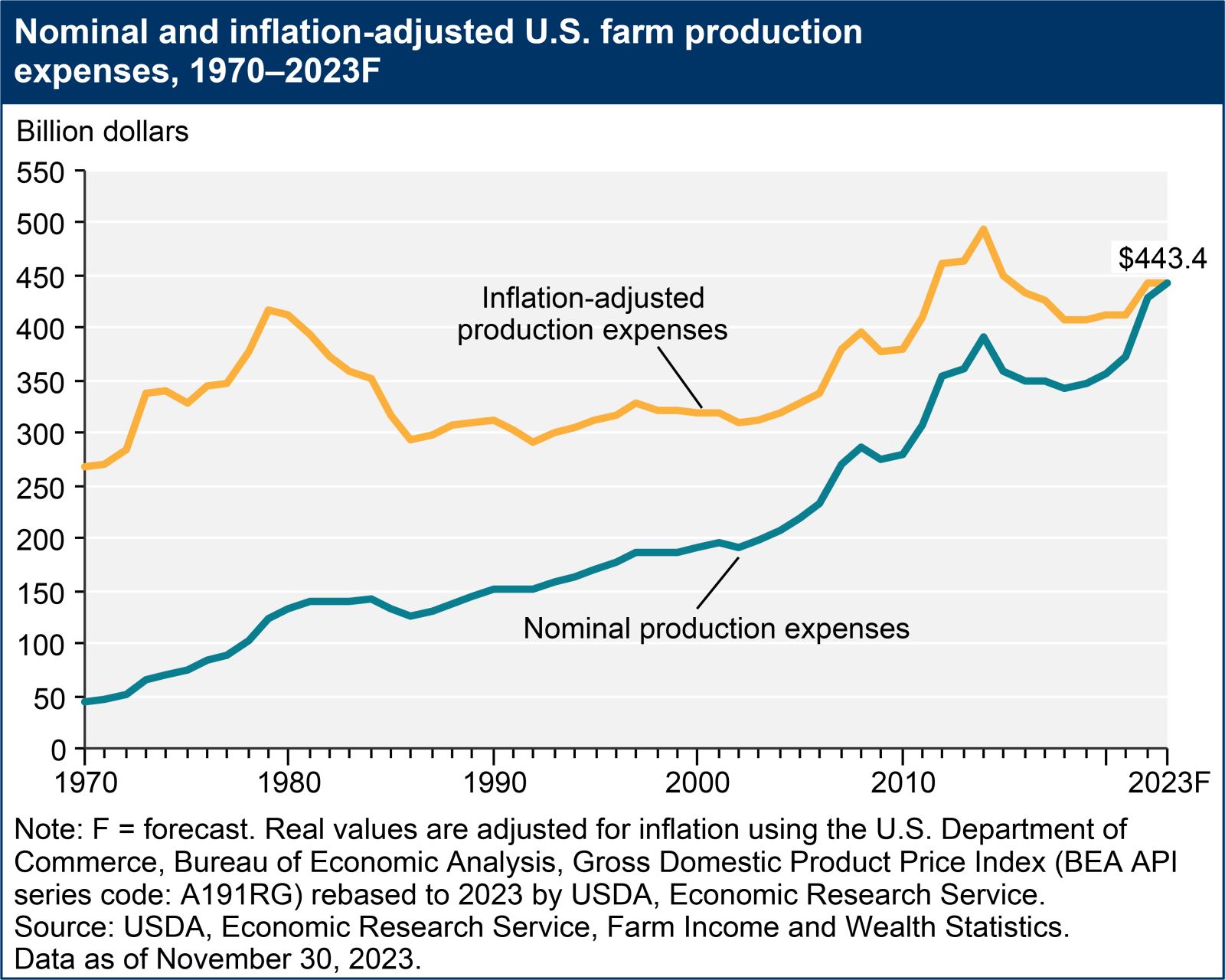

Farm sector production expenses, including expenses associated with operator dwellings, are forecast to increase by $14.9 billion (3.5 percent) from 2022 to $443.4 billion in 2023. However, when adjusted for inflation, production expenses are forecast to remain comparable to the 2022 level, increasing by only 0.1 percent from 2022 to 2023, and remaining below the record-high level of 2014.

See data tables on production expenses.

Spending on feed, labor, and livestock/poultry purchases are forecast to represent three of the largest categories of spending in 2023. Feed expenses, the largest single expense category, are forecast at $81.6 billion in 2023, decreasing from the record-high 2022 level by 2.5 percent. Labor expenses (including noncash employee compensation) are forecast to rise by $1.6 billion (3.9 percent), reaching $43.5 billion in 2023. When adjusted for inflation, the labor forecast is still below the record-high levels observed in 2014 and 2017. Livestock and poultry expense is projected to grow by $6.8 billion (19.6 percent) to $41.4 billion. When adjusted for inflation, this forecast is the third highest on record, just below the levels of 1973 and 1979.

Two other expense categories are forecast to notably change in 2023:

- Interest expenses (including expense for operator dwellings) are forecast to have the most significant increase in nominal terms at $10.3 billion (42.9 percent above the 2022 value) to $34.4 billion in 2023. This reflects expectations that both total debt levels and interest rates will rise in 2023. While in nominal terms this level is forecast to be the highest to date, in inflation-adjusted dollars, interest expenses were at least 50 percent higher in early 1980s.

- Fertilizer expenses (including lime and soil conditioner expenses) are projected to have the most significant decline in nominal terms from 2022, falling $5.2 billion (14.1 percent) to $31.7 billion in 2023. The projected drop is driven by reductions in fertilizer prices.